Vanguard Personal Advisor Services Reviewed: How Good Are They?

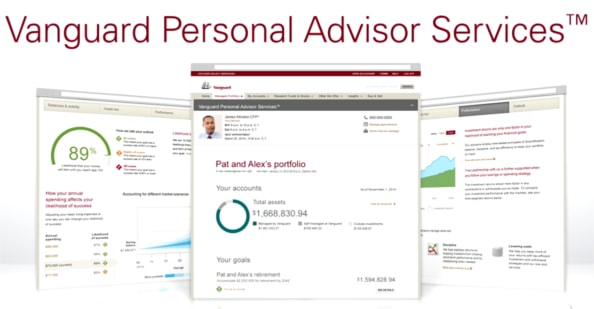

If you’ve been a part of the investment world for a while, you probably know of Vanguard. This American company is based in Pennsylvania and specializes in investment management. They have always wanted to be ahead of the game, which is why they constantly come up with new and interesting services. One of these services is called the Vanguard Personal Advisor Services and it is an automated investment service designed to advise you on your finances. It is more or less what we call a robo-advisor, a service that promises to advise you on how to manage your wealth using algorithms instead of actual human planners.

Today, we are going to review the Vanguard Personal Advisor Services and tell you what they promise, how they deliver, and if they are as good as they claim to be. Let’s begin!

Vanguard Personal Advisor Services Review

What Do They Promise?

The Vanguard Personal Advisor Services are a series of tools designed to provide you with the best advice in what concerns investment management. The ultimate goals is to help you achieve your investment objectives by devising a strategy on how to best allocate your assets. They promise to help you build your own financial plan that is customized according to what your general life goals are. Of course, they also pay a lot of attention to what kind of income you will be needing in the future, and whether or not you are currently investing your money into something.

Only after you are done with this detailed plan of how your finances look like and how you want them to look like in the future, the Vanguard Personal Advisor Services will help you choose the most appropriate types of investment for you.

Vanguard Personal Advisor Services vs Betterment

You may be wondering what is so special about the Vanguard Personal Advisor Services that it is worth your time and attention. Well, if we were to compare it to Betterment, which is one of the companies that first thought of this type of robo-advisor service, the Vanguard Personal Advisor Services also rely on the human component.

In fact, Vanguard does not approve of the name robo-adviser to describe their service, since they regard it as much more than just a simple algorithm. What the Vanguard Personal Advisor Services provide you with is an interesting hybrid that includes both an advisor that is computer-based and one that you can establish a more personal relationship with.

Vanguard Personal Advisor Services Brochure

All the work and mechanisms behind the Vanguard Personal Advisor Services are detailed in a brochure that you can find on their website. The brochure includes everything you need to know about these services, from how they work, to how they manage your accounts, what types of restrictions you can apply to your investment portfolio, how you can transfer assets or remove accounts, and many more useful information. So if you want to look at the full picture before deciding on these services, this brochure is definitely the best option.

Vanguard Personal Advisor Services Pros and Cons

Now, let us highlight some of the most important pros and cons of the Vanguard Personal Advisor Services.

Pros |

|---|

- The Human Component: Perhaps one of the most important pros of the Vanguard Personal Advisor Services is their personal touch. For all accounts, they manage to integrate a human side as well. People always feel more comfortable receiving advice from other people. Plus, a financial advisor is great in times of crisis or when you need to readjust your plan. You can access yours through video conferencing, via phone, and via email.

- Accessibility: Vanguard has also designed an app for you. With it, you can access your portfolio anytime you want using just your smartphone. Not to mention that you can access it online on your computer as well.

- Several Account Types: Another important proof this personal advisor service is the fact that you can choose from several types of accounts. These include the revocable trust account, the brokerage account, or the IRA.

- Several Investment Options: The account type is not the only thing you can enjoy variety in. Compared to its rivals, Vanguard offers a lot of investment options when using their service.

- Easy to Use: If you are worried that your experience with Vanguard might be complicated, worry not. The Vanguard Brokerage Services takes care of all the trades. That means they handle all the agreements between investment firms and brokers.

- Low Fees: The fee that you have to pay for managing your account is of 0.30% below $5 million. That is much lower than other similar services.

- Insured Accounts: Finally, we should mention the great insurance. If you decide to open up an account with Vanguard Personal Advisor Services, you will be covered. Your account will be insured up to $500,000 with the SPIC insurance, and up to $50,000,000 with Lloyd’s of London.

cons |

|---|

- No Personal Interaction: Even if unlike other similar services, Vanguard does offer a human component, it is limited. Clients can only get in touch with their advisors via email, phone, or video conference. Not meeting face to face might disappoint some people.

- Higher Cost: The cost we are referencing here is for a higher deposit account, where Vanguard charges more than other competitors. This might constitute an issue for clients who have more experience. It may also be a con for those who care more about costs than about the human component.

- High Minimum Deposit: In order to be able to use their services, Vanguard charges a minimum deposit of $50,000. This can be a lot for people who are just starting with their investmenting and don’t have the necessary experience.

- No Automatic Tax Loss Harvesting: You can indeed rely on the Vanguard Personal Advisor Services tax loss harvesting. Still, this is only if you specifically ask for it when talking to your personal adviser. It can be risky, and the company does not recommend you to use this feature regularly.

The Verdict: How Good Are the Vanguard Personal Advisor Services?

If you are looking for a platform with automated advice on your finances and investment, Vanguard is your best choice. They will also allow you to talk to a real person when you have questions or things to clarify. Especially if you are just starting your journey in the world of investments, the low fees are something to look forward to. As long as you still have the initial sum of $50,000, that is. If you are looking to invest more, the higher costs might seem like the service is not worth it. Still, the amount of professionalism and consistency that you get make up for this. Overall, the Vanguard Personal Advisor Services are well worth your time and money.

Follow

Follow