The Best Time To Start Debt Management

Debt Management Helps Cultivate The Field Rather Than Dig A Hole

Debt is not as bad as many people think it is. Debt, when used in the right way, in the right proportions and for the right reasons can be used as a leverage to further your financial potential rather than be a cause of stress and sleepless nights. Among other things, debt helps you own a car, buy a home or send you to school. Proper debt management ensures that when you swipe your plastic cards or ink a contract for credit, you are not digging a hole to bury you.

Good Debt Management Starts With A Good Plan

With the economic downturn hitting so many people, debt woes are breaking out like a deadly plague. When the epidemic spread, it was only then did some people start adding debt management into their vocabulary and asking debt management companies to help define it for them. Debt management should start as soon you start entertaining the idea of borrowing. After all, management starts with the process of planning.

Count How Much You Have

Before you apply for a loan or make a collection of credit cards in your purse, be aware of how much you have and how much you need to cover for your expenses. Make sure that the former is greater than the latter. This will help you determine whether you have extra funds to shoulder payment to your creditor should you start borrowing.

Set Aside Funds Before You Take A Loan

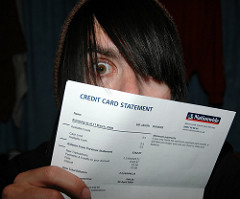

“What?! I am cash-strapped, that is why I am planning to borrow money. Then, you’re asking me to save?” If this is your reaction to this tip, chances are you have not heard of the advice that the best time to borrow is when you have the cash to make the payments. You put yourself in a dangerous position if you swipe that card for lack of cash to avail of a product on sale. Do you have the cash to pay it in full when the due date comes? If not, that means you are digging that dreaded financial hole.

Know How Much You Owe

Knowing how much you have and having salted some funds away, you are now ready to get that loan. But before you do, window-shop! Perhaps this is your forte. But do not just shop around for the item that you want to buy, but also compare prices and terms of the loan or credit card company that you will be borrowing from. Stop getting distracted by the big bold red letters announcing special sale events, discounted prices, and especially no money down or zero interest. Instead be on the lookout for the fine prints that could charge you hefty penalties and fees.

Have A Say On How Much You Should Pay

Take control of you payments to ensure that you do not lose control of your financial obligations. Make a plan on how much and how often you must pay for credit that you got. Although credit card companies set a monthly minimum due, keep in mind that you pay interest for the remaining balance and that your debt will continue to grow while you have an outstanding balance. The best thing to do is pay for the full amount before the due date. If you cannot afford to do so, do not swipe that card.

Follow

Follow