Compound Interest is the best!

If you don’t know about compound interest prepare your mind to be blown. It’s magic time. It is literally a stalwart in the quest to become wealthy, no joke!

What is Compound Interest?

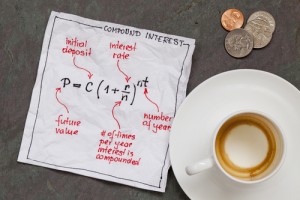

Like its name suggests, compound interest is a method for calculating the interest charged on the principal. In contrast to simple interest which calculates the same interest in period after period, compound interest sees the interest added to the principal at the end of each period, meaning that the principal is increasing throughout the process.

For example, suppose that an investment of $5,000 is earning 6 percent interest on an annual basis. Under simple interest, the investment would be earning $300 yearly, meaning that the total earnings by Year 10 would be $3,000. This seems remarkable until the same scenario is run using compound rather than simple interest. Then, the same investment would earn $300 in Year 1, $318 in Year 2, $337.08 in Year 3, and so on and so forth, resulting in total earnings of $3,954.24 by Year 10. That is 33% more money in your pocket because the principal and interest compounded over those 10 years.

The Power of Compound Returns

Now that “What is compound interest?” has been answered, it is time to explore the investing potential of a compounding principal.

In brief, a compounding principal undergoes exponential growth. This means that a compounding principal builds momentum over time because it grows faster and faster rather than remaining at a constant rate. Although the initial differences between simple and compound interest can seem small and inconsequential, spending a little time with a compounding interest calculator can reveal significant and even startling differences of outcome over the course of decades. So much so that with all else being the same, an investment with compound returns is always better than the same investment with simple returns. Check out our life calculator to see the power of compound interest over a lifespan. It’s an eye opener.

How You Can Use Compound Interest to Earn Compound Returns

So, how can interested individuals take advantage of compound interest to earn higher and higher rates of return over time?

Well, earning compound interest is simple because there is no financial instrument that cannot be used to earn compound returns as part of a portfolio. In fact, even the cash put into a savings account is earning compound returns, though in an inefficient and ineffective manner, especially in a low interest rate environment. So long as the earnings are reinvested in the portfolio, that can be considered an example of compound returns because the earnings are increasing over time. For example, if someone has a portfolio consisting of bonds and stocks, he or she can use the earnings to purchase more of the same, thus earning compound returns.

That said, the financial instruments used to earn compound returns should be based on the investment goal. For example, an investor interested in protecting his or her portfolio while still increasing its value could choose traditionally safer fixed income securities such as CDs, bonds, and bills. In contrast, an investor who wants maximum convenience with traditionally less risk due to diversification may consider entrusting his or her wealth to a mutual fund while choosing to reinvest the earnings in period after period. In reality anytime you are taking your principal and profit and reinvesting the total you are using the power of compound interest.

Of course, before investing your hard-earned cash, you may want to run your own calculations using a compound interest calculator on whatever investment you are considering. Lastly keep in mind that a well-honed sense of caution is an excellent thing when it comes to investing. Do your due diligence.

Follow

Follow