Let's talk Annuities! You spend the better half of your life working hard, so you can settle into an easy retirement – free of debt and free of burden. Face it – no one wants to be paying back a mortgage or car loan well into his 60s. Retirement is meant to be stress-free – for you to enjoy all the things you sacrificed while you worked professionally. But how can you live a stress-free life? One answer may be … [Read more...]

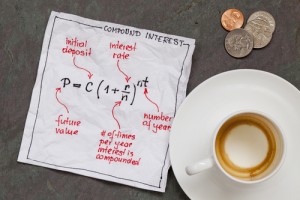

What are Annuities?

Discover more

- Siti Scommesse

- Casinos Not On Gamstop

- UK Online Casinos Not On Gamstop

- UK Online Casinos Not On Gamstop

- Casino Sites Not On Gamstop

- Siti Casino Non Aams

- Online Casino Canada

- Non Gamstop Casino UK

- Meilleur Casino En Ligne

- Non Gamstop Casinos

- Non Gamstop Online Casinos UK

- Non Gamstop Casino UK

- Top Casino Sites UK

- Siti Scommesse Italiani

- Gambling Sites Not On Gamstop

- Non Gamstop Casino UK

- Casinos Not On Gamstop

- Non Gamstop Casinos UK

- Non Gamstop Casino

- UK Casinos Not On Gamstop

- Betting Sites Not On Gamstop

- Casino Non Aams Sicuri

- Migliori Casino Online

- No Deposit Betting Sites Not On Gamstop

- Meilleur Casino Crypto

- Casino En Ligne Fiable

- Sites De Paris Sportifs Belgique

- рейтинг казино з хорошою віддачею

- Casino Sans KYC

- Meilleur Casino En Ligne France